12004 issued on 30 June 2004 provides clarification on. Rental income is valued on a net basis which means that the net rental income can be reduced with certain deductible expenses.

Beyond The Moratorium Eviction Courts Must Use Community Navigation To Get Rent Relief To Tenants Quickly Texas Housers

The letting of the house is a non-business source and the rental income is taxable under paragraph 4.

. In 2015 things change you move back out and rent the home once again. 30 SEPTEMBER 2021 Page 1 of 53 1. 42005 dated 30112007 and Second Addendum to Public Ruling No.

Rental income business is derived from the letting out of office lot in a 4-storey building. Public Ruling 92020 - Taxation of Trusts Public Ruling 102020 - Reinvestment. On 152009 the tenancy of a major portion of the office lot ends and the company only manages to get new tenants on 152011 absence of tenants for a period of 24 months.

Broadly the PR explains the taxation of. For a year is RM500 while quit rent is RM50 a year. D Paragraph 131d of the ITA.

I letting of real property as a business source under paragraph 4 a of the Income Tax Act 1967 ITA. ON SPECIAL CLASSES OF INCOME Public Ruling No. It replaces PR 42011 dated 10 March 2011 please refer to our e-CTIM No132011 dated 1 April 2011.

It sets out the interpretation of the Director General in. 11 the treatment of rent as a non-business source of income under section 4d of the Income Tax Act 1967 the Act. 122018 - INCOME FROM LETTING OF REAL PROPERTY The Inland Revenue Board of Malaysia LHDNM issued Public Ruling PR No122018 Third Edition on 19 December 2018 reported in our e-CTIM TECH-DT 972018 dated 21 December 2018.

The defined value of the living accommodation is RM24000. 13 September 2018 Page 5 of 36 8. Based on Public Ruling PR 122018 the rental income is considered to be a business income if you provide support or maintenance services comprehensively and actively to your property.

This PR which supersedes PR No. The legal theory is that upon purchasing a property in the community a new homeowner is deemed to have accepted the covenants in the declaration which is a public record. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia.

Interest allowable RM4000 restricted 2000 Statutory income NIL 260000 x 30000 26000 300000 Gross income 36000 Less. Income from Letting of Real Property. DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA.

Computation of Adjusted IncomeLoss 81 Subsection 331 of the ITA provides that the adjusted income of an. Ii letting of real property as a non-business source under. The new 18-page PR comprises the following paragraphs and sets out 20 examples.

52018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. 36 Rent or rental income or income from letting includes any amount received for the use or occupation of any real property or part thereof including premiums and other receipt in connection with the use or occupation. Public Ruling No.

The rental income commencement date starts on the first day the property is rented out whereas the actual rental income itself is assessed on a receipt basis. Rental income - RM60000 Interest income - RM10000 The tax computation of AA Trust for YA 2018 is as follows. Objective The objective of this Public Ruling PR is to explain 11 gifts or contributions made by a resident individual that are allowable in determining the total income for a year of assessment YA.

Section 4 d Rental Income. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. Any members of the public who may have additional information regarding this case should contact the Essex County Prosecutors Office Financial Crimes Unit at 973-688-3041.

It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and procedure that are to be applied. New Public Rulings The IRB has issued the following public rulings. Gross income from employment under paragraph 131a of the ITA amounting to RM120000 for the year ended 31122005.

Rental income business decreases in the year of assessment 2013 since the premises is not let out for a few months while repair is being done to the premises. Dividend income RM Rental income RM 40000 x 30000 4000 300000 Gross income 2000 Less. A Ruling may be withdrawn either wholly or in.

Taxation of Income Arising from Settlements dated 13 August 2021. 52021 Date of Publication. 42005 dated 1292005 Addendum to Public Ruling No.

The Inland Revenue Board IRB has issued Public Ruling No. Offer rental reduction to B for the month April May and June 2020 of RM2500 a month. Section 4 a Business Income.

The IRB has published Public Ruling PR No. INCOME AND CHARGEABLE INCOME Public Ruling No. 23 January 2014 Published by Inland Revenue Board of Malaysia Published on 23 January 2014 Public Ruling No.

Item Without special deduction RM With special deduction RM Monthly rental income 5000 5000 Annual rental income 60000 60000 Rental reduction of 50 for April May and June 2020 RM5000 x 50 x 3 months 7500 7500 Annual gross rental income. 100 Resolution of amount of any payment of income made or apportionment of income or statutory income. For apportionment purposes New Jersey uses a single-sales.

Gross income from employment of Encik Ali under paragraph 131c. It must be provided by the owner himself or through hiring of a manager. 12 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

His employer also provides for him rent free living accommodation throughout the year 2005. 12 the situations or circumstances where rent or income from the letting of property can be treated as business income of a person under section 4a of the Act. You sell the home for 400000 at the beginning of 2016.

By or on behalf of the employer rent free or otherwise. Calls will be kept. At the end of 2014 the value of the home remains 400000.

Income of the trust body for the year ended 31122018 comprises. Company X would be required to remit to New Jersey a withholding tax on behalf of A for A s 20 share of Company X s income including Company Y s 2016 operational income and the income from the sale of Company Y s assets apportioned to New Jersey NJ. Arizona law explicitly protects members right to free-use unless a rental restriction is included in the declarations.

A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia. In consequence rental income business.

New Research Released On Emergency Rental Assistance Program Strategies National Low Income Housing Coalition

How Long Does An Eviction Stay On Your Record Lexington Law

Schedule C Or Schedule E For Rental Property Owners Airbnb Taxes

Your Questions Answered About Evictions And Rent In N H New Hampshire Public Radio

Click To Enlarge Student Accommodation Toddler Bed Apartment Finder

Pin On Social Affordable Housing Issues

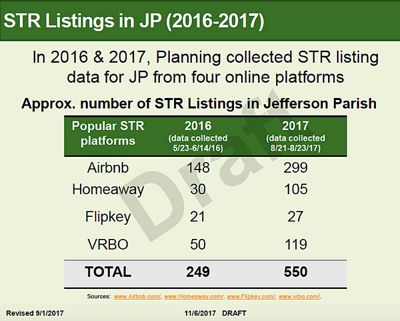

Extra Income Or Neighborhood Nuisance Short Term Rental Rules Weighed In Jefferson Parish Local Politics Nola Com

Rental Housing Program City Of Grand Haven

San Diego Could Soon Get A Vacation From Its Long Running Rental Showdown

Guide To Late Rent Fees For Landlords And Property Managers

Prediction For 2030 A Government Take Over Of Rental Housing

Time Is Running Out To Apply For Rent Relief Santa Monica Daily Press

Montgomery County Md 311 Answering To You

City Of Scottsdale Vacation Rentals Short Term Rentals

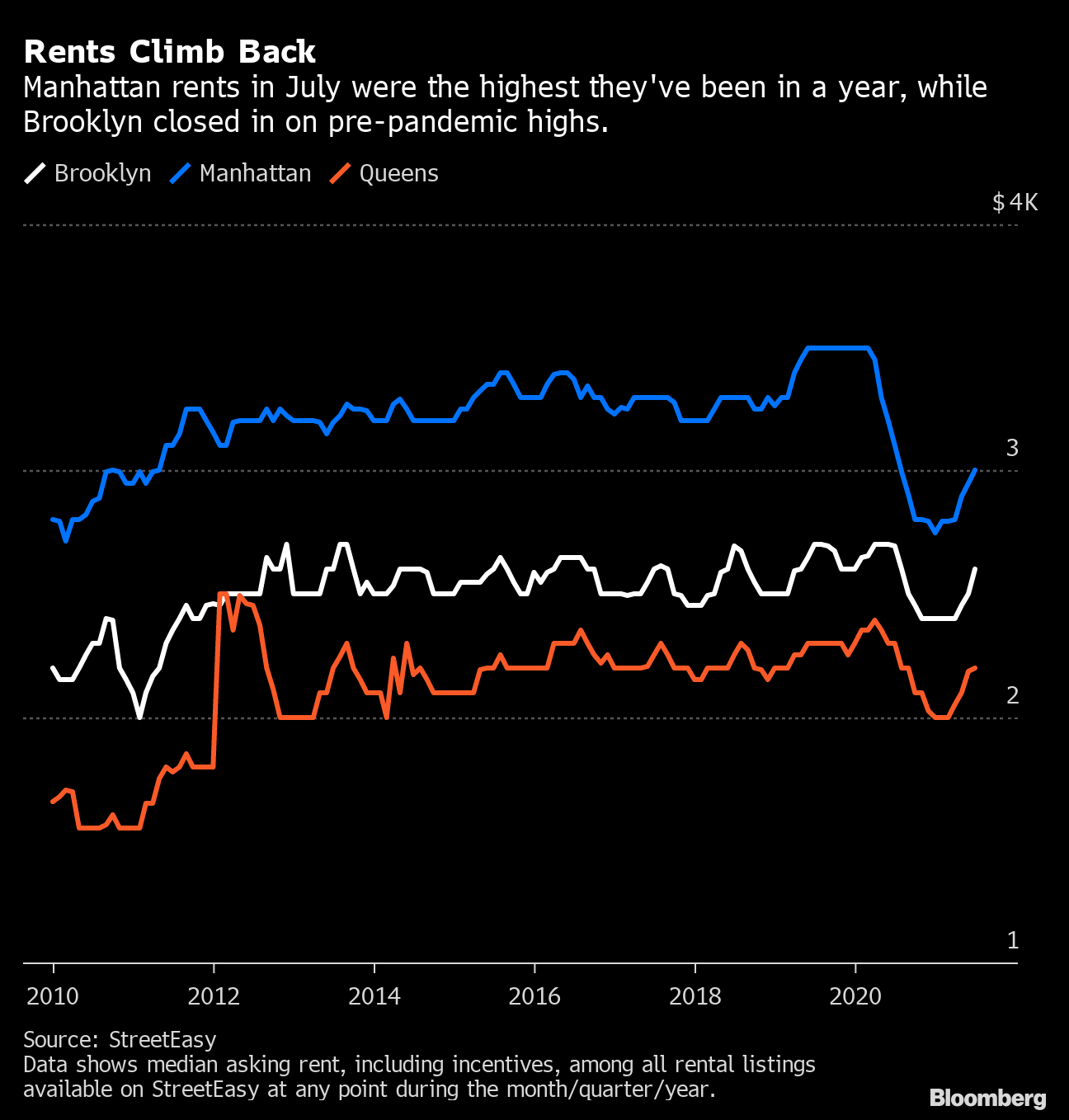

New York City Rents Landlords Jack Up Prices 70 In Lease Renewals Post Covid Bloomberg

In Depth California Statewide Rent Eviction Control Rules

Tax Consequences Of Charging Below Market Rent Laporte

Nlihc And Housing Initiative At Penn Release Joint Report On Lessons For Permanent Emergency Rental Assistance Programs National Low Income Housing Coalition

/RentalRealEstateDeductions_GettyImages-172793963-05ab9cd106794eb1bae14b7ce93312b1.jpg)